Tucson 2018 Overview

Every February the gem and mineral world descends on Tucson, transforming the downtown convention center and a great many of the city’s hotels into a fascinating collage of traders bearing goods from all over the planet (figures 1 and 2).

Many of the exhibitors we spoke with described 2018 as the strongest year since 2008. Although traffic wasn’t especially heavy at the AGTA and GJX shows, most dealers there enjoyed brisk sales and healthy demand for high-quality goods. Some of the same trends from last year were evident. Customers still sought out one-of-a-kind pearls and colored gemstone pieces, and the secondary market in the U.S. for exceptional pieces remained highly significant. There was a continuing focus on untreated material and ethically sourced gemstones, a subject articulated for us by Jean Claude Michelou of the International Colored Gemstone Association and officials from the Responsible Jewellery Council. Market realities such as very strong price competition for newly mined gem rough were mentioned as a major challenge by many dealers and cutters.

In addition to strong demand for high-end gems, many dealers at AGTA and GJX reported a surge in more moderately priced goods. Meanwhile, dealers at other locations told us the commercial end of the market remained soft.

Pantone’s color of the year for 2018, a shade of purple called Ultra Violet, was well represented at the shows. A couple of dealers had exceptional examples of purple sillimanite. Many dealers posted strong sales of pastel-colored spinel—in pink and lavender hues—in suites and sets as customers found the scarcity and high prices of red spinel prohibitive. In a similar vein, Margit Thorndal of Madagascar Imports reported strong demand for purple-lavender spinel and purple sapphire from Madagascar, as well as teal hues of unheated Montana sapphire.

We noted that electric blues, teals, hot pinks, hot yellow greens, and pastel-colored gems were quite popular. Bill Larson of Pala International pointed to this trend and showed us a number of spectacular examples from his inventory. Fine blue zircon from Cambodia was prominent, as was attractive sphene from Zimbabwe and Madagascar.

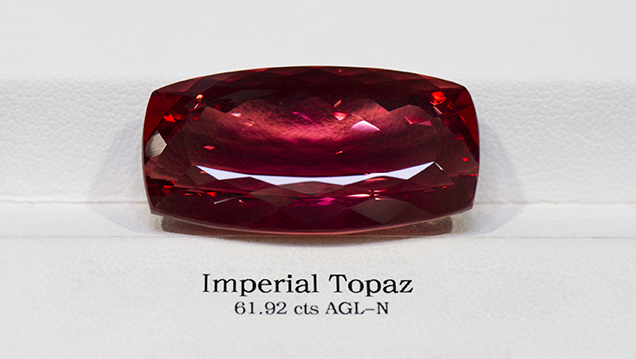

Dave Bindra of B&B Fine Gems said his company was very active in scouring the secondary markets for old jewelry items and gemstones that have been out of circulation for decades. This year’s standouts were two incredible red beryls from Utah (a 3 ct emerald cut and a 4 ct round brilliant), a 61.92 ct Imperial topaz (figure 3), and a fine selection of Kashmir sapphires, which were very sought after this year. Fran Mastoloni of Mastoloni Pearls updated us on current trends in the cultured pearl market and showed examples of unique pieces.

Dealers specializing in domestic gems reported strong demand. John Woodmark of Desert Sun Mining & Gems told us the market for Oregon sunstone was the strongest he had seen since the andesine controversy challenged suppliers of the natural Oregon gem a decade ago. As a result, the company has scaled up its mining activities and built new relationships with gem cutters to improve supply to its clients.

As always, the Tucson shows were a rich source for the latest on global colored stone supply. Conversations with Luis Gabriel Angarita and Edwin Molina revealed insights on the mining and branding of Colombian emerald. Marcelo Ribeiro shared details on mining and cutting at the Belmont emerald mine in Brazil. Alexey Burlakov offered his perspective on Russian demantoid production, while Stephan Reif did the same for demantoid from the Green Dragon mine in Namibia. Miriam Kamau shared information on her Kenyan tsavorite mining operation and offered her own inspirational success story. From Jürgen Schütz of Emil Weis Opals we learned about the cutting of opal, both play-of-color and nonphenomenal, from sources around the world. Alexander Arnoldi explained Arnoldi International’s strategy in sourcing and cutting high-quality aquamarine and tourmaline. We also saw examples of gem production from unexpected sources: Indonesian opal and turquoise from the state of Arkansas.

Tucson is also a destination for many leading gem artists and jewelry designers. Award-winning carver Michael Dyber explained the inspiration behind some fantastic one-of-a-kind pieces bearing his signature optical disks. At the intersection of science and art, Rex Guo discussed his approach to recutting gems to optimize light performance and beauty. And designers Paula Crevoshay and Erica Courtney showed us striking and innovative new pieces with unexpected and fascinating gem combinations.