Jaipur, India: The Emerald Cutting and Trading Powerhouse

, , , , , andFebruary 8, 2016

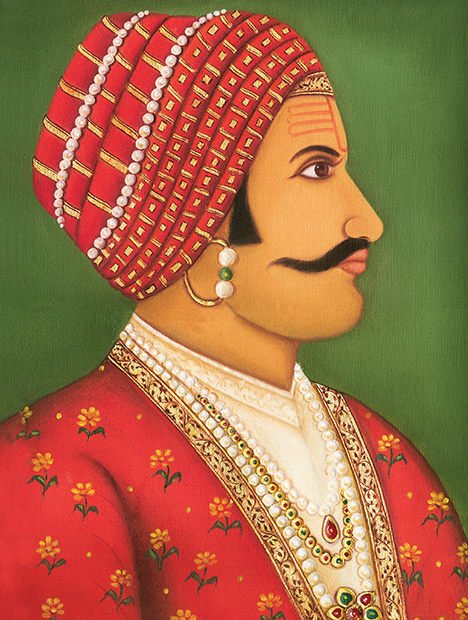

Jaipur, India, the historic pink city that is the capital of Rajasthan, is an exciting place of palaces and forts, Mogul history, grooms in traditional attire traveling to weddings on elephant, and a global leading colored gemstone cutting and trading industry. Jaipur is also a hub for jewelry manufacturing. The jewelry industry here dates back to the early 1700s, when the city was founded by Maharaja Sawai Jai Singh II, the Raja (king) of Amer. Early in the city’s history, great importance was placed on bringing in top craftsmen, including jewelers, to create fine products for the royal family and to make the city a leading center for producing fine-quality luxury products.

great patrons of craftsmen, including jewelers. Photo courtesy Surana Jewels.

JAIPUR EMERALD INDUSTRY

Today Jaipur combines traditional colored gemstone cutting and jewelry manufacturing factories and artisans with the most modern production facilities and techniques. While Surat, India, is a center for diamond cutting and diamond jewelry manufacturing, Jaipur focuses on colored gemstone cutting and jewelry manufacturing. Thailand and Sri Lanka are known more for ruby and sapphire cutting, treatment, and trading, and Jaipur is known for cutting, trading, and creating jewelry with a wide variety of colored gemstones and as one of the leading emerald cutting and trading centers in the world.

ROUGH EMERALD SOURCES

Jaipur’s emerald cutting industry receives emerald rough primarily from Zambia but also from Brazil (mostly from mines in the state of Bahia). While Colombia is a famous major emerald producer, much of its production is cut there, especially better-quality material, with some of the lower-quality material cut in Jaipur. A high percentage of the rough cut in Jaipur today is from Zambia, higher than all other sources combined.

by Andrew Lucas/GIA, courtesy Samit Emeralds/Real Gems Inc.

Zambian rough comes to Jaipur cutters through Gemfields auctions of stones from their Kagem mine in Zambia and from other Zambian mining sources. The Gemfields auctions have significantly changed Jaipur’s emerald industry. They now have a regular supply of emerald rough that is consistently graded and separated into logical parcels. The parcels are very consistent auction to auction over the years. This has made matching emeralds, planning business models, and providing customers a reliable supply much easier. The movement to accurate, consistent grading of parcels has been spreading through the industry. Some independent Zambian producers still sell mixed-quality parcels and entire mine productions to the Jaipur industry, but overall the consistently graded parcels from Gemfields and other producers like brokers in Bahia, Brazil, are welcomed.

THE GIA JAIPUR EMERALD INDUSTRY EXPEDITION

In spring 2015 a GIA team from GIA Carlsbad and GIA India visited Jaipur to document their entire gem and jewelry industry. The emerald industry was one of the sectors we focused on due to its high importance to the industry in Jaipur and the global emerald industry. We visited three companies that focus on different sectors of the emerald industry and have different business models.

Two companies we visited are part of the same New York–based company, Real Gems Inc., but they cut different market sector goods, one higher quality and one more commercial quality. The third company cuts and sells its goods to foreign buyers in Jaipur. All three have different business models for procuring rough, different buying strategies, and different final customers. Together they represent significant strategies of Jaipur’s emerald industry as a whole. We interviewed the companies’ owners and management and extensively documented their manufacturing facilities through photos and video.

Real Gems, Inc. of New York City is a family business with over 40 years in the emerald industry. They source emerald rough and cut stones from major source countries including Colombia, Brazil, and Zambia. The rough is cut at their manufacturing facilities and through partners in Jaipur, India. Real Gems, Inc. sells a wide variety of sizes and qualities, from precision-calibrated 1-mm rounds to unenhanced stones over 50 carats. With offices in New York, Hong Kong, Dubai, Bangkok, and Europe, they strive to fill any order within 48 hours.

MULTIGEM CREATIONS/REAL GEMS INC.

Multigem Creations cuts for Real Gems Inc., based in New York City. The company has been in business for over 25 years and started out cutting commercial-quality Bahia material. By 1998 they moved to cutting primarily Zambian material, and as their emerald cutting experience increased, they moved to cutting medium- to high-quality emerald rough.

higher-value rough from Zambia due to the consistent supply and the cutting knowledge

they gained over the years. Photo by Andrew Lucas/GIA, courtesy Multigem Creations/

Real Gems Inc.

Since higher-quality emerald takes more time and care to cut as more money rides on the decisions, the quantity of emeralds produced has gone from 20,000 carats a month during the years of cutting lower-quality material to 2,000 carats a month now. However, the revenue from the carats they cut has also dramatically increased. This must be balanced with the fact that post-cutting profit margins have shrunken in today’s highly competitive market.

to realize a profit. Orientation for weight retention, best face-up color, clarity, and how

treatment will affect the appearance takes years and preferably decades of experience to

determine and to be competitive in today’s market. Photo by Andrew Lucas/GIA, courtesy

Multigem Creations/Real Gems Inc.

Multigem Creations buys their emerald rough almost exclusively at Gemfields auctions. While bidding for parcels is fiercely competitive, the consistently graded lots offer a supply that allows them to provide their customers consistent high-quality large free-size medium- to high-quality faceted emeralds, precision calibrated emeralds, and high-quality cabochons and tumbled stones.

As with most emerald cutting factories in Jaipur, Multigem Creations incorporates traditional equipment into their production. The art of cutting emeralds in Jaipur is based more on experience and knowledge than technology and state-of-the-art equipment.

SAMIT EMERALDS/REAL GEMS INC.

Samit Emeralds also uses traditional equipment as part of the production process. Emerald is a complex stone to cut in all qualities. It does not lend itself to advanced technology and computerized cutting as some stones do, such as blue topaz and citrine. There are considerations for color orientation, weight retention, and complex clarity factors. An understanding of how treatment will affect the stone’s appearance is also required as treatment is typically done after cutting.

Samit Emeralds cuts large quantities of commercial-quality emeralds for New York City–based Real Gems Inc. Although they used to buy heavily from the emerald mines in Bahia, Brazil, in recent years Bahia’s production dropped and the quality available was lower than needed. Now Samit Emeralds buys emerald rough primarily from Gemfields auctions and other Zambian sources. While they obtain some lower-quality Colombian material, they find the color a bit too light in the qualities available to them. Owner Samit Bordia estimates that 90 percent of the rough emerald cut in Jaipur is from Zambia and Brazil. Today the percentage of rough that Samit Emeralds cuts by value is 90 percent Zambian and 10 percent from Bahia, Brazil.

Samit Emeralds buys rough to fill orders placed by customers. Large amounts of calibrated emeralds are constantly in demand by television jewelry companies in the United States. They cut a higher percentage of more included rough for faceted gems than some other Jaipur companies that might prefer to cut them into higher-quality cabochons. As a general rule, if the inclusion is more than 20 percent of the rough stone, they saw the stone; if it is less than 20 percent, they grind it to remove the area. Through highly detailed records over the years of the rough starting weight, preformed weight, and final cut weight, they are able to predict the weight loss percentage from rough often to within a couple percentage points. This is very helpful when purchasing or bidding for rough in today’s very competitive market.

GREEN INTERNATIONAL

Ram Das Maheshwari of Green International feels that the Gemfields auctions have changed the whole dynamic of their business and of the Jaipur emerald industry. He estimates that Green International buys 99 percent of its rough emerald production from Gemfields auctions. He also estimates that since they began buying the well-graded, consistent, and organized rough emerald lots from Gemfields auctions, his ability to turn inventory over has increased by 500 percent. Mr. Das Maheshwari finds that the intense competition and lower margins today are more than compensated for by the ease of manufacturing and turnover enabled by the well-sorted auction lots.

expertise, and market knowledge. Photo by Andrew Lucas/GIA, courtesy Green International.

In contrast to some other emerald manufacturers, Green International does not base purchases on customer pre-orders. They buy based on getting the best value for the money and then cut the rough for the best possible balance of weight retention and quality. Then they offer the goods for sale to other local dealers and international buyers in the Jaipur market. An important part of their business is selling matching suites to jewelry manufacturers.

When Green International bought primarily Brazilian rough, almost all of their business was calibrated goods. Now that they buy Zambian material, they still cut a lot of calibrated material but also more high-quality free-size stones. They feel that the traditional bow-powered wheels for preforming and hand-controlled jam peg machines for faceting give their highly experienced cutters more control of the cutting. This also gives them an extra 2 percent weight retention over more modern equipment, along with better control of the stone’s orientation and final quality.

Andrew Lucas is manager of field gemology for education at GIA Carlsbad, Nirupa Bhatt is managing director for GIA India and Middle East, Manoj Singhania is director of Education at GIA India, Kashish Sachdeva is a gemology instructor at GIA India, Dr. Tao Hsu is technical editor of Gems & Gemology at GIA Carlsbad, and Pedro Padua is video producer at GIA Carlsbad.

DISCLAIMER

GIA staff often visit mines, manufacturers, retailers and others in the gem and jewelry industry for research purposes and to gain insight into the marketplace. GIA appreciates the access and information provided during these visits. These visits and any resulting articles or publications should not be taken or used as an endorsement.

The authors gratefully thank Real Gems Inc., Multigem Creations, Samit Emeralds, and Green International.