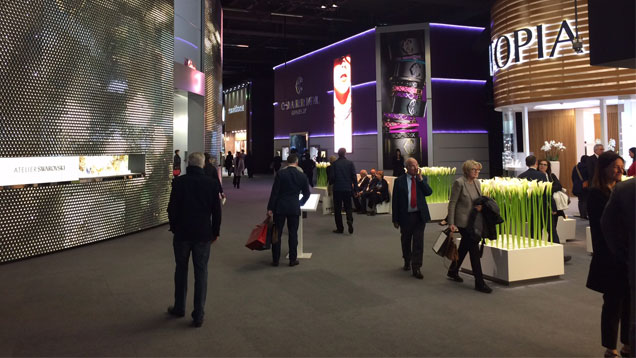

Baselworld 2016: Spotty Demand; Glitz Out, Rare In

April 14, 2016

Distinctiveness reigned over bling at the Baselworld show in Switzerland. Traffic was down and business spotty at the March 16-23 show, though a number of exhibitors said demand had improved from last year.

The smart sellers adapted to a changed market, offering the rare, unusual and distinctively designed in place of (or in addition to) high carat weights for their own sake.

Exhibitors noted that buyers were looking for jewelry, not investments which require buyers to pay for gemstones with devalued currency, making a profitable resale very difficult. In previous years at the show, sellers of large diamonds estimated that at least one-third of all diamonds larger than 5 carats were bought for investment, not jewelry.

Indeed, for years, sellers of large, high-quality diamonds and colored gemstones at the Baselworld fair could count on brisk demand from a diverse group of private clients, largely from Russia, China and the Middle East.

Demand for such stones has slowed considerably for the past two years at the show, however, because of a confluence of events: a concerted crackdown of large cash transactions; a rising U.S. dollar that raises the costs of these goods by 10% to 40% in other currencies; economic slowdown in China and other previously fast-rising economies; and depressed prices for oil and other commodities.

Colorless diamonds larger than 5 carats were a difficult sell at the show. As one dealer of major stones put it: “Very few buyers from Russia and the Middle East were here − they used to account for a lot of the high-ticket demand.”

The dealer did say that prices for top stones have not softened as they had for more commercial diamonds because most dealers have the financial capacity to hold on to them until demand improves. Additionally, unlike the commercial diamond market, buyers of large diamonds rarely try to save money by down trading quality.

“They either want the best, or will not buy,” he said.

Demand for commercial-sized diamonds did pick up at the show and the market in general. One reason is that prices have fallen to levels where, as one exhibitor put it, “manufacturers and their clients now want to do business.”

He added that the “green shoots of recovery” are buoying the diamond market, but it remains fragile. “We have to worry whether the mining companies will raise prices again, whether China’s economy has truly hit the floor, whether the problems in major European banks will bring another downturn and whether terrorism and refugees will disrupt the world economy. It’s a lot to worry about, but we must stay optimistic.” The March 22 terror attacks in Brussels, about 350 miles north of Basel, prompted city police and fair management to conduct random searches of attendees’ briefcases and bags and limit access to the show to the front entrances.

Demand for colored stones was extremely selective. Buyers were looking for extremely fine Burmese rubies, no-oil Colombian emeralds and rarer stones like Kashmir sapphires.

“The ultra-wealthy now want exceptional stones they can get nowhere else,” said one dealer. “But the demand for stones in the $20,000 to $50,000 range is vanishing. The trouble is, once you sell these unique stones, it’s almost impossible to replace them.”

One dealer was showing a Namibian demantoid garnet necklace with 28 round cuts totaling 128 carats (cts.). The dealer said it took eight years to assemble, particularly because the color of each stone was apple green instead of the customary olive color and, because very few 2-ct. plus demantoids of that color are mined each year.

Another dealer displayed a 50.09 ct. purple-to-violet color-change sapphire from an estate, which, he claimed, sparked a lot of interest and a pearl dealer offered a 20.48 mm x 23.21 mm drop shaped South Seas cultured pearl.

The high-end jewelry houses and luxury watch companies that debut their products at the fair put their focus more on design and less on the gem-covered look of a few years ago.

“Fewer diamonds, strategically placed for maximum show,” is how Chopard put it for their new “Happy Diamonds” watch line. This line had four 5 millimeter (a bit less than 0.5 cts.) diamonds floating inside the watch dial. The focal point was on craftsmanship and design said the company.

Even Laurence Graff, known for some of the costliest diamond jewelry in the world, took a step back from ultra-bling to create a more modest line of sapphire and diamond watches in its “Butterfly” collection.

Swiss watch makers reported that exports of luxury watches made there declined nearly 8% during the first two months of the year, largely because of a 33% decline to Hong Kong (continuing a year-long slide), where the Chinese slowdown has hit hard, and 13.7% fall in sales to the U.S., where ostentatious luxury is falling out of favor.

Also at the show, a Russian synthetics manufacturer displayed a 5.03 ct. Fancy Deep blue it claimed to be the largest blue diamond ever grown by the HPHT process. The company said it took much more than a week to grow and is in the process of creating additional synthetic blues.

Russell Shor is senior industry analyst at GIA in Carlsbad.