Sapphire Series Part 4:

Gem Synthetic Sapphire and Diffusion-Treated Synthetics

October 23, 2013

The answer is complex. The industrial sapphire market has changed the landscape of the gem synthetic sapphire market, in that production has shifted to new locations, particularly Asia. Meanwhile, associated input costs such as raw materials, equipment, and other consumables have been affected both positively and negatively. The synthetic gem industry has grown, as more consumers seek affordable luxury.

Yet the industrial sapphire market dwarfs the gem segment. Over the past several decades, synthetic sapphire output has increased from fewer than 100 metric tons annually—when production centered on synthetic gems—to around 1,000 metric tons per year, thanks to the widespread adoption of technological applications. In response, dozens of new crystal growth operations have emerged around the globe, vastly increasing capacity. This means sustained demand is necessary to avoid dramatic price drops and market gluts.

While all colors of gem synthetic sapphire are possible, demand and production are focused on blue, orange, pink, and red. Rich, saturated blue hues are the hardest to create and therefore the priciest. Many producers who tried growing blue have exited the industry or switched to pink, red, or colorless.

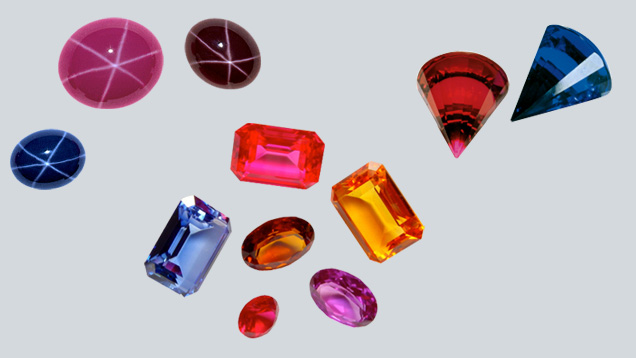

Figure 1. These Vernueil (flame-fusion) synthetic sapphires illustrate a wide variety of cuts and colors. Photo courtesy of Djeva.

Synthetic sapphire rough and cut gems grown by the Verneuil, Czochralski, hydrothermal, and flux techniques are readily available, as are diffusion-treated cut synthetic sapphires. Verneuil (flame-fusion) material can be grown in a matter of hours, and it is inexpensive and plentiful (figure 1). This material is often annealed for a day or two to relieve stress. It shows very distinct curved growth striations and strain and may require careful orientation if the color distribution is not uniform. Flame-fusion sapphire originated in Europe, but operations have emerged in Armenia and China. Some Verneuil facilities that began as gem crystal growth operations have partially or completely switched to high-purity colorless sapphire for industrial applications. This has resulted in fewer available gem synthetic sapphire colors.Conversely, some Czochralski growth capacity traditionally focused on industrial applications has switched to gem sapphire growth, as equipment sometimes is liquidated for a fraction of the original cost. The Czochralski technique is advantageous for growing gem synthetic sapphire in that these crystals are large—generally ranging from five to 20 kilograms—providing a large amount of highy uniform faceting rough. Czochralski synthetic sapphire (figure 2) takes days to weeks to grow. It has uniform quality and color but may exhibit color banding and round bubbles.

Figure 2. These Czochralski-grown sapphires and rubies were produced by Union Carbide Corporation. Photos by Jennifer Stone-Sundberg.

Hydrothermal (figure 3) and flux materials are grown by processes that take months or even a year to produce, but these crystals exhibit very uniform color distribution, far less strain, and more natural-looking inclusions than synthetics grown by the other methods. There is a niche market for “luxury” synthetics such as solution-grown corundum, but it is much smaller than the demand for mass-produced flame-fusion material.

Figure 3. This blue Tairus hydrothermal sapphire ring is accented by colorless synthetic sapphires. Photo courtesy of Tairus.

The retail pricing of synthetic gem corundum has remained relatively flat over the past couple of decades, even with increasing demand. There are now more producers, particularly in regions with lower operating costs. Just as crystal growth techniques vary widely, so does the retail pricing of faceted gem synthetic sapphires. These goods can range from $1 to $1,000 a carat. The blue synthetics are consistently more expensive in both rough and cut forms, and can be two to three times the price of the least expensive varieties, colorless and pink. Considering the vastly different crystal growth rates among the various techniques, it is not surprising that lengthier processes result in higher per-carat prices, limited supply, and a smaller market for their products. (Also, the price of the key raw ingredient, aluminum oxide, becomes less important.)A survey of the marketplace revealed that most flame-fusion faceted synthetics retail for less than $5 per carat. Czochralski specimens cost an order of magnitude higher, and solution-grown material costs an additional order of magnitude higher—capping out at around $900 per carat. For each of these growth methods, rough material costs about one-tenth the price of faceted goods. Retail prices for diffusion-treated faceted synthetic sapphire are similar to those for flame-fusion material.

In comparison to the stagnant synthetic gem prices, the wholesale price of volume orders of high-purity white flame-fusion “crackle”—a key raw material used in high-tech sapphire growth—has fluctuated considerably over the past several years, reaching highs of $120 per kilogram (about 2.4 cents per carat) and lows of $40 per kilogram (about 0.8 cents per carat). Meanwhile, colorless rough has been selling to faceters in smaller quantities for approximately 10 cents per carat. Flame-fusion rough in various colors from Wuzhou, China, where hundreds of companies are active in the synthetic gem market, is available for 1−3 cents per carat.

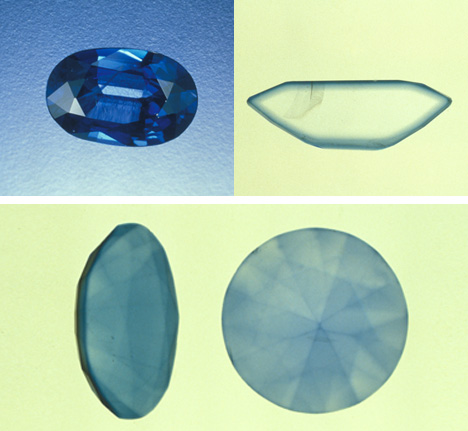

Figure 4. Top: This diffusion-treated blue synthetic sapphire shows the shallow depth

of the treatment, confined to a surface layer. Bottom: Diffusion treatment is evident in the

color concentrations along the girdle and facet junctions. From Robert E. Kane et al.,

“The Identification of Blue Diffusion-Treated Sapphires,” Summer 1990 Gems & Gemology;

photos by Shane F. McClure.

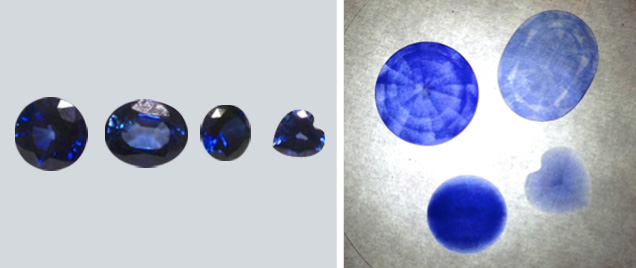

The similarities between the natural and synthetic sapphire markets extend beyond the parallels in quality range and pricing. Both natural and synthetic sapphire can be diffusion-treated to produce various effects and colors—in fact, colorless synthetic sapphire that has been diffusion-treated to induce a blue color is widely available (figure 4). Diffusion treatment of synthetic sapphire has been documented since the 1950s. As with natural sapphire, diffusion-treated synthetics are considerably less expensive than untreated specimens. Growth methods and treatments are not always disclosed, especially in less-expensive material. Nevertheless, diffusion-treated blue synthetic sapphire is easy to detect in an immersion cell filled with liquid of matching refractive index; the treated gems display color concentrations along facet junctions and the girdle, as shown in figure 4 (bottom) and figure 5 (top right). Diffusion-treated blue synthetic sapphire is inferior to grown blue sapphire in that the treatment is very shallow, eliminating the possibility of recutting. The treated goods may also be less transparent, as the thin diffused surface may exhibit noticeably different optical qualities from the bulk of the cut specimen. Fortunately, easy and inexpensive detection methods reduce the potential for confusion when purchasing a synthetic sapphire gem.of the treatment, confined to a surface layer. Bottom: Diffusion treatment is evident in the

color concentrations along the girdle and facet junctions. From Robert E. Kane et al.,

“The Identification of Blue Diffusion-Treated Sapphires,” Summer 1990 Gems & Gemology;

photos by Shane F. McClure.

Figure 5. The photo on the left shows (left to right) a diffusion-treated synthetic sapphire from JTV, a diffusion-treated synthetic sapphire from Gem Resources, a flame-fusion synthetic sapphire from Gem Resources, and a Czochralski synthetic sapphire from Union Carbide Corporation. Right: Viewed in immersion, diffusion-treated blue synthetic sapphires clearly show outlined girdles and facet junctions (top), unlike the as-grown blue stones (bottom). Photos by Jennifer Stone-Sundberg.

I believe we will see a dramatic increase in the production of diffusion-treated blue synthetic sapphire originating from colorless material—a trend that could bring down the price of higher-quality synthetic blue sapphire. This is reminiscent of the concerns over beryllium-diffused natural sapphire a decade ago, when the market was flooded with pinkish orange padparadscha sapphire. We could start seeing much more of this material in a range of colors, given the large volume of high-purity and very clean commodity-priced colorless sapphire being produced. In the future, I would like to see full disclosure of growth technique and treatment for all synthetic gems, as having such information is of value to the consumer.

ABOUT THE AUTHOR

Jennifer Stone-Sundberg is managing director at Crystal Solutions, LLC, and a technical editor of Gems & Gemology. She specializes in crystal growth and characterization technology.